- Hotline+971 50 27 28 29 1

- for Individual offices click here

STA's Team of Lawyers in Abu Dhabi, Bahrain, Doha, UAE, Luxembourg, Moscow, RAK, Sharjah, and Singapore. Find a Lawyer. ..

Read more informationDIFC Qualifying Employer Workplace Savings Scheme

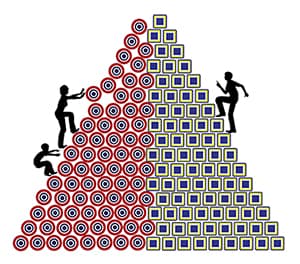

In the early part of the year 2019, Dubai International financial Centre Authority (DIFCA) proposed in the consultation paper to revise the end of service gratuity (ESG) regime. ESG regime was proposed to be replaced with contributions-based-savings.

In the early part of the year 2019, Dubai International financial Centre Authority (DIFCA) proposed in the consultation paper to revise the end of service gratuity (ESG) regime. ESG regime was proposed to be replaced with contributions-based-savings.

In February 2020, the DIFCA brought amendments to the DIFC Employment Law Number 2 of 2019 specifically with regards to Article 66 that governed erstwhile ESG. The DIFCA proposed qualifying scheme which is designed and revolves around concept of “employment money purchase scheme”, as DIFC follows common law or English Law principles. The qualifying scheme would be closely modelled on UK Pension Schemes 1993 that defines the term money purchase benefits as the benefits the rate or amount of which is calculated solely by reference to assets. Therefore, the qualifying scheme shall make provision for:

The Qualifying Scheme that is promoted by DIFCA is termed as DIFC Employee Workplace Savings (DEWS). But, the DIFCA has given freedom to employers to choose any other Qualifying Alternative Scheme (QAS).

The salient features of the Qualifying Scheme are:

The employer beginning from 1st February 2020 is obligated to make employer contributions as per the following calculations:

The employer beginning from 1st February 2020 is obligated to make employer contributions as per the following calculations: