UBO Disclosure Requirements- UAE

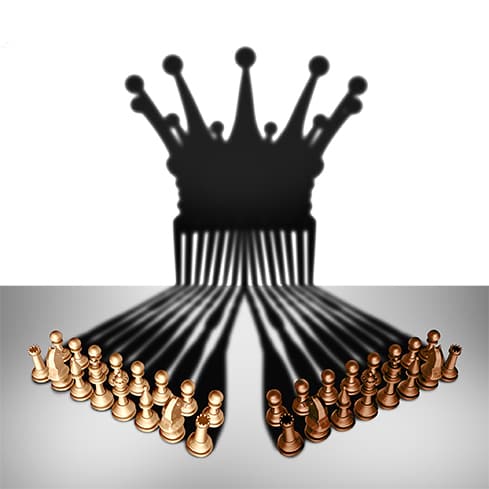

In recent years, counter-fraud, money laundering and terrorism funding have been the regulator's highest priority. Fraudulent parties conceal their service using offshore accounts, and authorities report fraudulent transacts routinely at fake emails, PO boxes or private residences. This term has taken on an increasingly significant role in the fight against terrorism and money laundering. "Ultimate Beneficial Ownership", UBO refers to the individual or organisation who eventually profits from the company.

In recent years, counter-fraud, money laundering and terrorism funding have been the regulator's highest priority. Fraudulent parties conceal their service using offshore accounts, and authorities report fraudulent transacts routinely at fake emails, PO boxes or private residences. This term has taken on an increasingly significant role in the fight against terrorism and money laundering. "Ultimate Beneficial Ownership", UBO refers to the individual or organisation who eventually profits from the company.

UAE's Administrative Cabinet Resolution Number 58 of 2020 entered into force and regulation on August 28, 2020, and replaced Cabinet Resolution Number 34 of 2020 released earlier this year. As per the resolution passed, the organisation must report its beneficial owners with new conditions regarding the regulation of UBO in the UAE. The primary aim is to increase the accountability of registered bodies in the UAE and establish effective and sustainable processes and regulatory procedures regarding beneficial ownership details.

The United Arab Emirates also adopted new rules for companies incorporated in the world in their attempts to grow into a fully open and reliable economy. Recently the Economic Content Laws have significantly changed the company set up in Dubai and are now expected for businesses to comply with the new ultimate profit ownership law. The UAE revised the criteria for corporate enforcement for true continental, free zone and offshore receivers by Cabinet Decision No. 58 of 2020. The Actual Beneficiary's need to reveal the details results from the UAE's attempts to restrict money laundering financial crimes.

In accordance with this decision, the last beneficial owner's of the company's registry shall be maintained and enforced by businesses registered in the UAE or free areas (UBO). The organisational structure for which the best AML/CFT consultants in Dubai provide services can be decided in the mainland and the free areas companies.

A UBO may be defined as all those who have or control your company directly or indirectly for the Real Beneficiary Register. It has voting control of 25 percent or more of an entity's equity capital of at least 25 percent. Anyone with other means such as management authority to recruit or fire retains ownership rights.

If no clarification is made concerning the individual with ultimate power and no such requirement is met by the UBO, the entity that otherwise manages the business is deemed an actual benefit. Unless the company will determine the individual as UBO, the real beneficiary is the senior management's individual. Visit best AML/CFT consultants in Dubai to find out more about UBO requirements.

What do companies do?

Any business in the United Arab Emirates, both free zone and mainland must maintain its office:

- Partners or Shareholders Register(PSR)

- Real Beneficiary Register (RBR)

- Register of Nominee Directors

What needs to maintain a UBO register?

According to the Cabinet Resolution, UAE companies must create a UBO registry containing details concerning the actual beneficiary:

- Full name

- Nationality

- Date and Place of Birth

- Place of Residence and Address

- Passport

- ID number

- Date and basis on which the person became a UBO

- The date on which the person ceased to be a UBO

Companies must continually update the register. In addition, businesses must notify the registrar within 15 days of this change or change any given information. Moreover, the companies must appoint an individual to be told of any disclosure by the registrar.

Rules (For Listed Companies)

Rules (For Listed Companies)

The companies listed in stock exchanges or companies that are owned by listed companies should rely on the disclosures they have already made to the stock exchanges. They are not needed to make separate notifications concerning the UBO. The decision of the cabinet on the Real Beneficiary shall extend to all persons in the mainland and companies in the free areas, except as follows:

- Companies Registered in Financial Free Zones (DIFC, ADGM); and

- Companies owned by the Federal government & its Subsidiaries.

The Decision of the Cabinet also points out how UBO legislation relates to liquidating firms. When a company is dissolved or liquidated, within 30 days of the Liquidator appointment, the official liquidator must send a true copy of the UBO registrar's updates to the registrar. Companies must comply or face a list of sanctions levied by the UAE Ministry of Economics (MOE). However, the list of administrative sanctions must also be released by the MOE. In order to escape penalties triggered by non-compliance, contact the best AML/CFT consultants.

AML/CFT Consultants in Dubai, UAE

UBO disclosure was first implemented in the banking industry, where banks where companies had to disclose details about their UBO during the opening process of the bank account. Accordingly, during corporate creation in the UAE, some free zones (JAFZA, DMCC) had also introduced the UBO divulgation provision. Yet, before the publication of the Cabinet Resolution Number 58 of 2020 most licencing agencies in the UAE have pressed for such standards.

Now, the provision for disclosure of companies in mainland, onshore and commercial-free areas has been extended after the decision (except the financial free zones). Under the new legislation, businesses need to maintain a UBO registry and provide the registrar with details on the Real Beneficiary. Their ownership structure will be evaluated by the companies and experts provided by the best AML/CFT consultants in Dubai, including Jitendra Business Consultants (JBC). JBC has a highly trained team of corporate organisation experts and chartered accounts to ensure compliance. JBC trains and guides company personnel to manage the RBR and Partners or Shareholders Register (PSR). JBC also helps company owners retain the records on their behalf and offers secretarial services to ensure that they properly manage and update the registers and comply with the legislation while incorporating, renewing and amending them.

As described further below, companies in the UAE are expected to define and maintain the registries of final beneficial owners and notify local authorities of the benefits of the gain to owners following the cabinet resolution's publication on real benefit proceedings or UBO regulations last August 28 2020. "Negotiated owners" apply to entities with influence or possession of a business following the regulations:

- possession of 25 percent or more of equity or more of the corporation's voting rights, or more than 20 percent;

- having other company interests or influence through other means such as the power to nominate, exclude or dominate the majority of the board members.

The regulation requires UA/EA Entities to plan and to report to the required authority, within sixty (60) days of the date the resolution or by the date on which the resolution is adopted (unless the exemptions are applied), the Last Beneficial Owner ("UBO") register, the Nominating Director Register (if applicable) and the Partners or Shareholders register. More guidance is required in the field of submissions issued by several other free zone authorities and the Department of Economic Development (for onshore entities). This resolution applies to all UAE approved entities except:

- Financial free areas organisations (Abu Dhabi International Financial Hub and Global Markets); and

- Companies owned by the Federal or Emirates Government directly or indirectly.

It is to be noted that no reference should be made to publicly released information in the registers, and all the information is supposed to be retained and kept only for use by authorities.

Registration of UBOs

- UBOs are naturally individuals who ultimately own or control the company or have the ability, by direct or indirect ownership or by the right to nominate or remove a majority of its Directors and Managers, to vote with a minimum of 25 percent of its shareholder.

- Any individual who regulates the business by other means shall be deemed a UBO when no person fulfils the above condition.

- If the natural person does not meet the requirements mentioned above, a natural person responsible for its senior management shall be called the UBO.

Companies planning to enter into operations or restructuring in the UAE shall apply legislative forms to be signed or signed by at least two proposed directors with effect from October 25 2020, along with the Articles and the Memorandum of Association the case of a single director. Companies should recognise each beneficial owner and state explicitly the existence and scope of benefits held by each ultimate beneficial owner. Unless they are happy with the declaration required by specific rules met, DED and other licencing bodies can not proceed with company registration.

Established corporations must also supply the registrar of companies with their UBO records. The details required are company elderly names, business names, legal form, articles and association memorandum, headquarters addresses and more.

Offences and Penalties

If a duty laid down in the Beneficial Owners Procedures Legislation is not complied with, a corporation and a company manager may be responsible for several liabilities. In some instances, the beneficiary owners and shareholders are also penalised for defaults and regular sanctions which continue to be enforced if there is a default. These several breaches should be avoided:

- Failure to keep business profit owner's records;

- Late introduction of information on changes to beneficial ownership of companies to Registrar of Companies;

- Registration of business registrars containing information regarding beneficial owners of the company; and

- Failure to collect, update and provide correct details for beneficiaries for six months after the publication of the regulations.

Note: any shareholder, official, or beneficial owner, who makes a declaration, declaration or receives false, disappointing or misleading information recklessly or intentionally by the registry office shall be liable for a criminal offence punishable by legislation.

Officials in the UAE who do not keep records of ultimate profiteering owners shall not be kept liable if appropriate evidence is provided for adherence, due diligence and proof that the failure is not due to incompetence, omission or conduct on their part. Officers are excluded from all liabilities.

Any alteration to the information found in the registers of authorities is to be recorded within fifteen days of the introduced modifications. Within thirty days of the liquidators' appointment, named liquidators shall be needed to send actual copies of the revised UBO registers to the companies registrar.

Overall, the need for corporate accountability, particularly about ownership and tax needs, has been stressed more and more. Several municipalities have turned the desire for transparency into structured reporting of productive land, strengthening businesses' need to examine their structure and ensure they meet various local publication standards. A significant example is implementing the European Union 4th AML Directive on anti-money laundering (4th AML Directive) (EU). The 4th AML Directive allows the EU Member States to create databases of legal entities' ultimate beneficiaries (UBOs) among other steps designed to battle cash-laundering and terrorist finance. Individual Member States were able to decide how the directive should be applied, and the member states took various approaches in doing so.

EU Member States had a deadline of June 26, 2017, to enact legislation implementing the 4th AML Directive, but discussions continue to be held about how the directive should be enforced, who should access the registry, and how much legislation in practice would increase transparency.

One of the main issues concerning the directive's application concerns data protection: who can and for what purposes be accessed in the registry. Under the directive, the appropriate authorities, financial intelligence units and any individual or entity that can show a 'legitimate interest' should be provided with information. The benefits register is at present voluntary for the Member States. However, the European Commission, the European Parliament and the Council of the European Union recently decided to amend the directive in the form of a 5th Directive, making the register obligatory for public access.

Conclusion

This paper offers an initial overview of how the Fourth AML Directive application stands at present, particularly the various conditions for UBOs to be defined and registered in different countries of the EU. In the various EU Member States, significant fines may result if the registration conditions are not complied with. Therefore, it is recommended that all companies with a UBO within the scope of the Fourth AML Directive be aware of the new regulations to ensure that in each EU State in which you have a legal entity, you comply with the UBO registration requirements of the company.

This paper offers an initial overview of how the Fourth AML Directive application stands at present, particularly the various conditions for UBOs to be defined and registered in different countries of the EU. In the various EU Member States, significant fines may result if the registration conditions are not complied with. Therefore, it is recommended that all companies with a UBO within the scope of the Fourth AML Directive be aware of the new regulations to ensure that in each EU State in which you have a legal entity, you comply with the UBO registration requirements of the company.

- UBO registrations, shareholders and directors candidates shall be made available by all UAE bodies, except as excluded by the resolution, by 27 October 2020.

- Registers shall be filed by 27 October 2020, with the competent authority of UBOs and partners/owners and nominees' directors. Although onshore companies and some free zones are still not subject to confirmation of the filing mechanisms.

- Any changes or modifications to the information given to the appropriate registrar must be informed by the organisation within 15 days of such changes or modifications.

English

English

عربي

عربي Русский

Русский 官话

官话 português

português

Türk

Türk