Company Formation in Dubai Airport Free Zone

In its early years, the renowned Emirates airlines had to lease aircraft(s) from its counterparts in Pakistan to meet the growing demand in the aviation industry in the Middle East. Although, the global airline sector back then was not the same as it is today and Emirates was not the only player in the market that was looking to make a mark. A large number of investors recognized this growing demand in the airline industry and hence, set up companies in various jurisdictions with the aim of exploiting the surge in air travel due to globalization and international trade. However, with high demand, comes greater competition; and this force airline company to have at least one of the following factors in their favor to sustain the heavy competition: (i) abundance of financial resources and/or (ii) a strategic location and dynamic business environment to succor the airline’s growth. Hence, the tale of Emirates varies slightly from that of the other carriers from this point onwards.

In its early years, the renowned Emirates airlines had to lease aircraft(s) from its counterparts in Pakistan to meet the growing demand in the aviation industry in the Middle East. Although, the global airline sector back then was not the same as it is today and Emirates was not the only player in the market that was looking to make a mark. A large number of investors recognized this growing demand in the airline industry and hence, set up companies in various jurisdictions with the aim of exploiting the surge in air travel due to globalization and international trade. However, with high demand, comes greater competition; and this force airline company to have at least one of the following factors in their favor to sustain the heavy competition: (i) abundance of financial resources and/or (ii) a strategic location and dynamic business environment to succor the airline’s growth. Hence, the tale of Emirates varies slightly from that of the other carriers from this point onwards.

Headquartered and operating out of Dubai, Emirates had a strategic advantage over the other airline companies due to the dynamic business environment and geographic location that Dubai offers. Therefore, thirty years hence, Emirates has established itself as one of the leading players in the global airline industry with a vast fleet of aircraft that fly to numerous destinations. But the story did not continue happily for every company in the industry. Airline companies are tied down by financial burdens that arise due to high operational costs, excessive competition, fluctuating oil prices and stringent domestic regulations. Therefore, investors looking to establish themselves in the airline industry should set up their companies in a jurisdiction that suits their business model and promotes healthy competition. In this regard, Dubai Airport Free Zone (DAFZA) is the peerless free zone that provides investors with state-of-the-art infrastructure and other dedicated facilities that are specially designed to cater the needs of the airline industry. Those considering company formation in Dubai Airport Free Zone will (we hope) find this article useful as well as resourceful.

Incentives and Benefits

Dubai has become home to numerous players in the shipping and airline industry due to its location in the Arabian Peninsula that provides direct connectivity to the African, Asian, European and American continents. Keeping this in mind, DAFZA opened its doors to the public in 1996 with the view of equipping the nation with a dedicated free zone that provides more than mere logistical convenience to airline companies. The DAFZA is equipped with various executive offices, suites, smart desks and light industrial units to suit the varying leasehold needs of the investors. Hence, the prestigious address at the heart of one of the world’s leading business hubs is only the first in a long list of advantages that investors in the free zone enjoy.

Establishing Your Entity

The DAFZA does not cater to airline industry alone; the free zone is also home to numerous companies from investments, insurance, restaurants and canteens, transport, shipping & storage and other industries too. Therefore, investors prior to commencing business setup in DAFZA should exercise due diligence and obtain the appropriate license (trade license or service license) to conduct their activities in the free zone. Further, investors may opt between the following legal entities to establish their presence in the free zone: (i) free zone company (FZCO) – can have between one (1) and fifty (50) legal or natural shareholders with a minimum share capital of UAE Dirhams one thousand (AED 1,000); or (ii) branch office – no minimum share capital requirement.

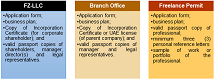

Investors should submit the following documents in respect of the type of legal entity that they intend to establish in the free zone:

|

Document title |

Free zone company (natural shareholder) |

Free zone company (legal shareholder) |

Branch office |

|

Application form |

ü |

ü |

ü |

|

Business Plan |

ü |

|

|

|

Letter of Intent |

ü |

ü |

ü |

|

Financial Report (audited) |

|

ü |

ü |

|

Company Profile |

|

ü |

ü |

|

Bank statement (dating to six months) |

ü |

|

|

|

Letter of Reference from Bank |

ü |

|

|

|

Passport Copy and Resume (shareholder(s)) |

ü |

|

|

|

Power of Attorney, specimen signature, passport copy & resume (Manager) |

ü |

ü |

ü |

|

NOC from Sponsor (for company established in UAE) |

ü |

ü |

ü |

|

Registration Certificate of Parent Company |

|

ü |

ü |

|

MoU & AoA of Parent Company |

|

ü |

ü |

|

Board Resolution of Parent Company |

|

ü |

ü |

|

Appointment letter, power of attorney, specimen signature & passport copy of legal representative (if needed) |

ü |

ü |

|

|

Power of Attorney, specimen signature & passport copy (Director) |

ü |

ü |

|

|

Power of Attorney, specimen signature & passport copy (Secretary) |

ü |

ü |

|

|

Letter from bank regarding share capital (if needed) |

ü |

ü |

|

Investors are advised to obtain and notarize the requisite documents mentioned above before initiating the company formation application to ensure that there are no undue delays in the process. Paving the way for innovation and new opportunities for investors, DAFZA provides a dynamic trade environment and state of the art facilities. Hence, with hundred percent foreign ownership and tax exemptions on all corporate, import and export tax, DAFZA is the ideal free zone for companies invested in logistics and airline activities.

[i] ‘Emirates prospers despite slump’, Flight International (24 October 1998).

English

English

عربي

عربي Русский

Русский 官话

官话 português

português

Türk

Türk